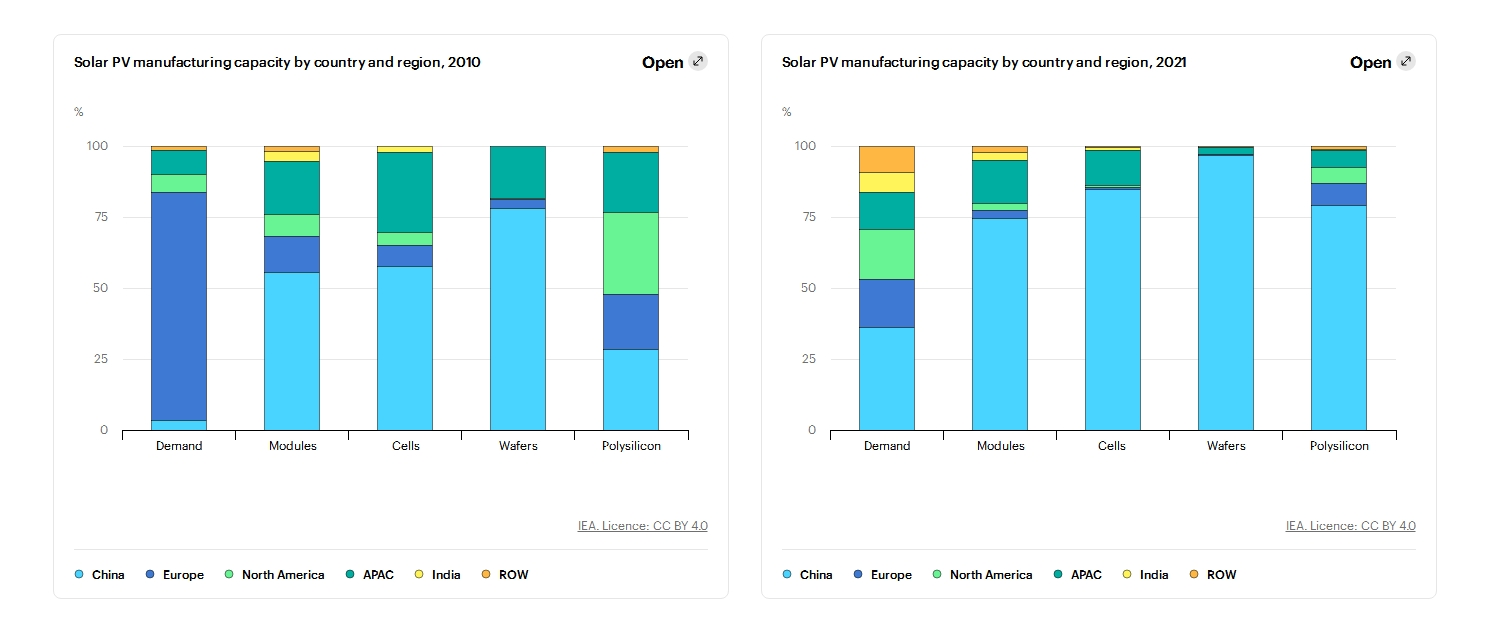

Global solar PV manufacturing capacity has increasingly moved from Europe, Japan and the United States to China over the last decade. China has invested over USD 50 billion in new PV supply capacity – ten times more than Europe − and created more than 300 000 manufacturing jobs across the solar PV value chain since 2011. Today, China’s share in all the manufacturing stages of solar panels (such as polysilicon, ingots, wafers, cells and modules) exceeds 80%. This is more than double China’s share of global PV demand. In addition, the country is home to the world’s 10 top suppliers of solar PV manufacturing equipment. China has been instrumental in bringing down costs worldwide for solar PV, with multiple benefits for clean energy transitions. At the same time, the level of geographical concentration in global supply chains also creates potential challenges that governments need to address.

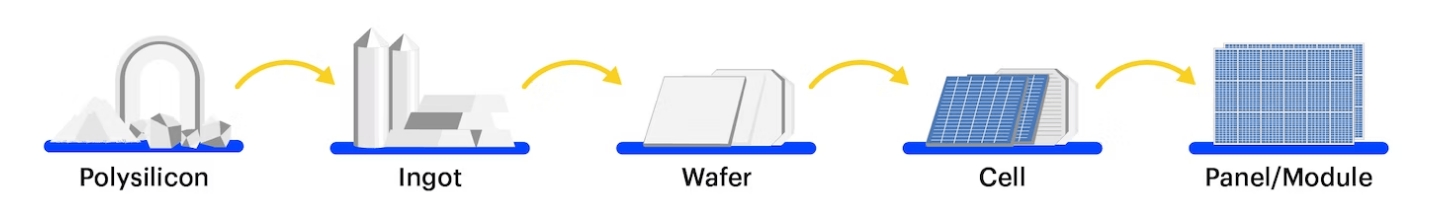

Key stages in the main manufacturing process for solar PV

Government policies in China have shaped the global supply, demand and price of solar PV over the last decade. Chinese industrial policies focusing on solar PV as a strategic sector and on growing domestic demand have enabled economies of scale and supported continuous innovation throughout the supply chain. These policies have contributed to a cost decline more than 80%, helping solar PV to become the most affordable electricity generation technology in many parts of the world. However, they have also led to supply-demand imbalances in the PV supply chain. Global capacity for manufacturing wafers and cells, which are key solar PV elements, and for assembling them into solar panels (also known as modules), exceeded demand by at least 100% at the end of 2021. By contrast, production of polysilicon, the key material for solar PV, is currently a bottleneck in an otherwise oversupplied supply chain. This has led to tight global supplies and a quadrupling of polysilicon prices over the last year.

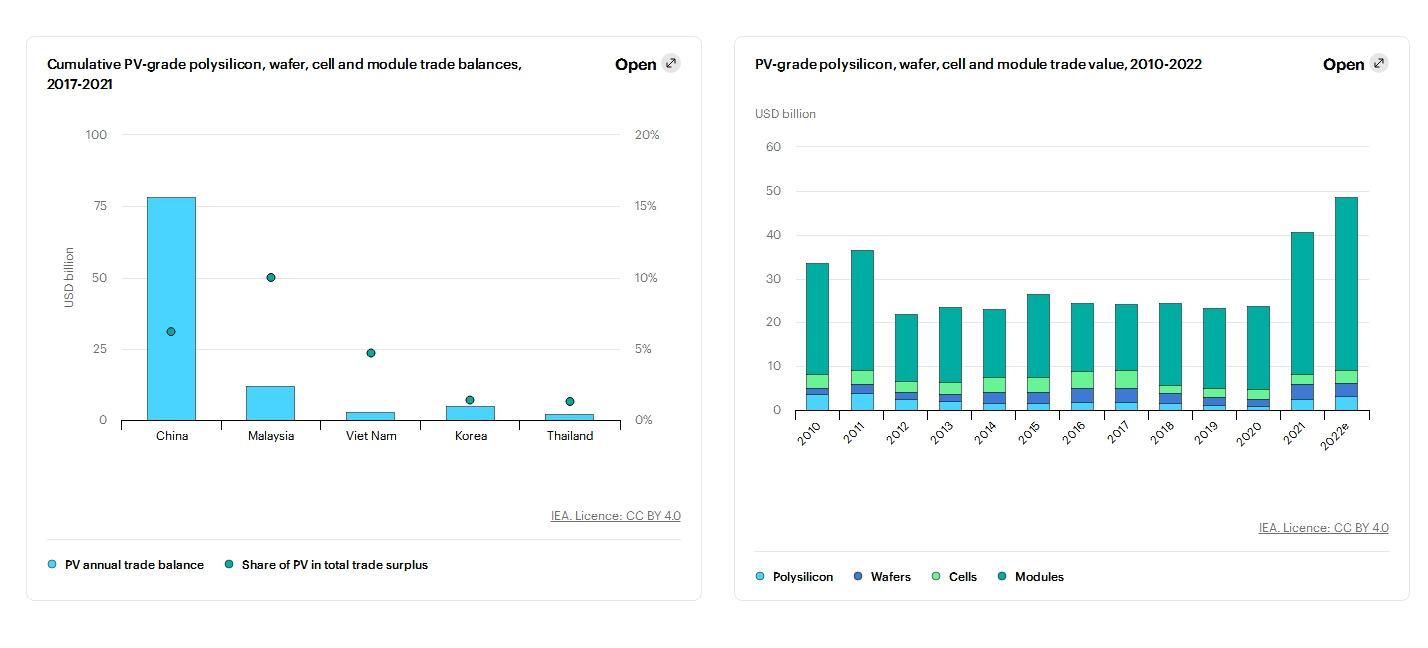

Solar PV products are a significant export for China. In 2021, the value of China’s solar PV exports was over USD 30 billion, almost 7% of China’s trade surplus over the last five years. In addition, Chinese investments in Malaysia and Viet Nam also made these countries major exporters of PV products, accounting for around 10% and 5% respectively of their trade surpluses since 2017. The total value of global PV-related trade – including polysilicon, wafers, cells and modules – exceeded USD 40 billion in 2021, an increase of over 70% from 2020.

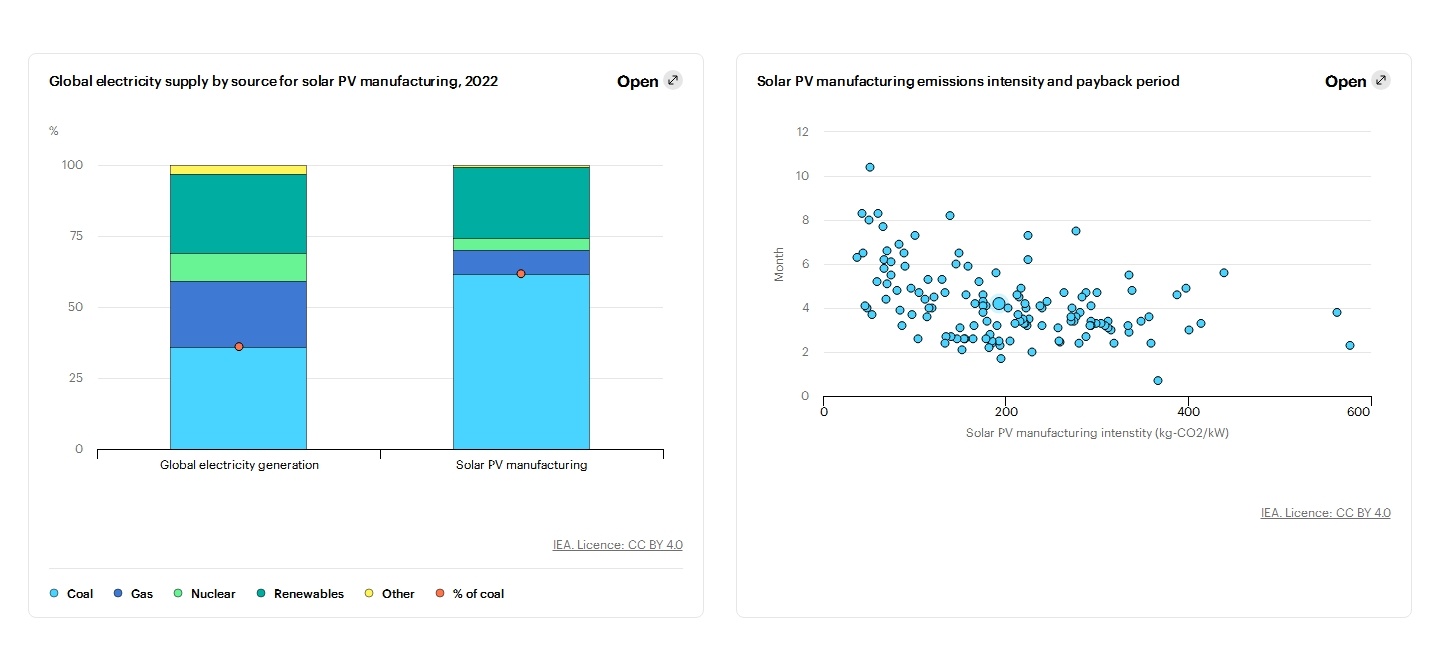

Today, electricity-intensive solar PV manufacturing is mostly powered by fossil fuels, but solar panels only need to operate for 4-8 months to offset their manufacturing emissions. This payback period compares with the average solar panel lifetime of around 25-30 years. Electricity provides 80% of the total energy used in solar PV manufacturing, with the majority consumed by production of polysilicon, ingots and wafers because they require heat at high and precise temperatures. Today, coal generates over 60% of the electricity used for global solar PV manufacturing, significantly more than its share in global power generation (36%). This is largely because PV production is concentrated in China – mainly in the provinces of Xinjiang and Jiangsu where coal accounts for more than 75% of the annual power supply and benefits from favourable government tariffs.

Continuous innovation led by China has halved the emissions intensity of solar PV manufacturing since 2011. This is the result of more efficient use of materials and energy – and greater low-carbon electricity production. Despite these improvements, absolute carbon dioxide (CO2) emissions from solar PV manufacturing have almost quadrupled worldwide since 2011 as production in China has expanded. Nonetheless, solar PV manufacturing represented only 0.15% of energy-related global CO2 emissions in 2021. As power systems across the world decarbonise, the carbon footprint of PV manufacturing should shrink accordingly. Transporting PV products accounts for only 3% of total PV emissions.

If there is intrusion, please contact delete.